How It Works

Gameday’s trading process is intended to be intuitive for users familiar with traditional exchanges, while integrating the benefits of blockchain technology.

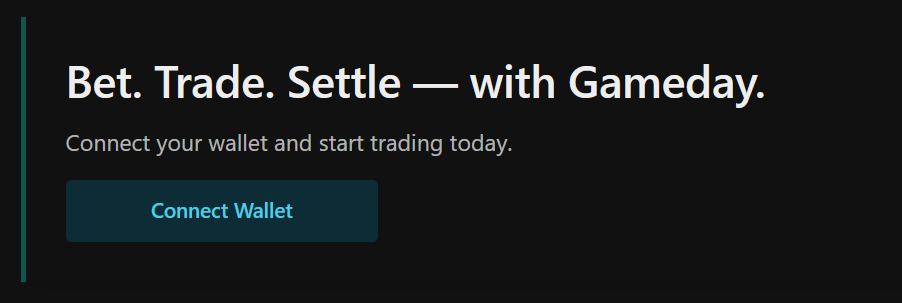

1. Connect Your Wallet

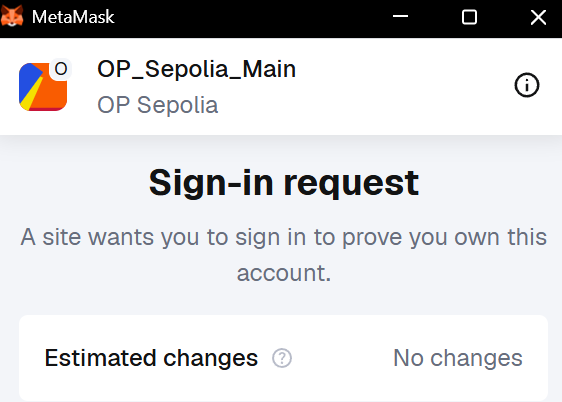

Begin by connecting an Optimism-compatible wallet, such as MetaMask. This step establishes your identity and ensures that your assets remain under your control until you choose to trade or settle.

- Click Connect Wallet button.

- Once connected, you will be prompted to sign a SIWE message to verify your identity.

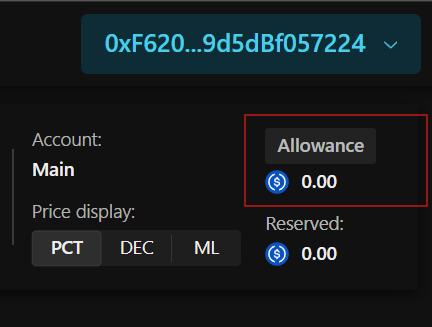

1.a. Approve Allowance

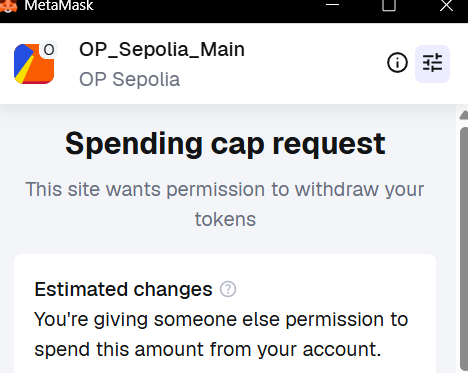

Before trading, you should set USDC ERC20 allowance for the Gameday Exchange contract. This sets a maximum amount of funds that the contract can access for trading, providing an additional layer of security and control over your assets.

- Click

Allowancebutton.

- Enter allowance amount - this will set a limit on how much you can spend on the exchange from your account.

- Approve spending cap request, verify that it is our Exchange contract.

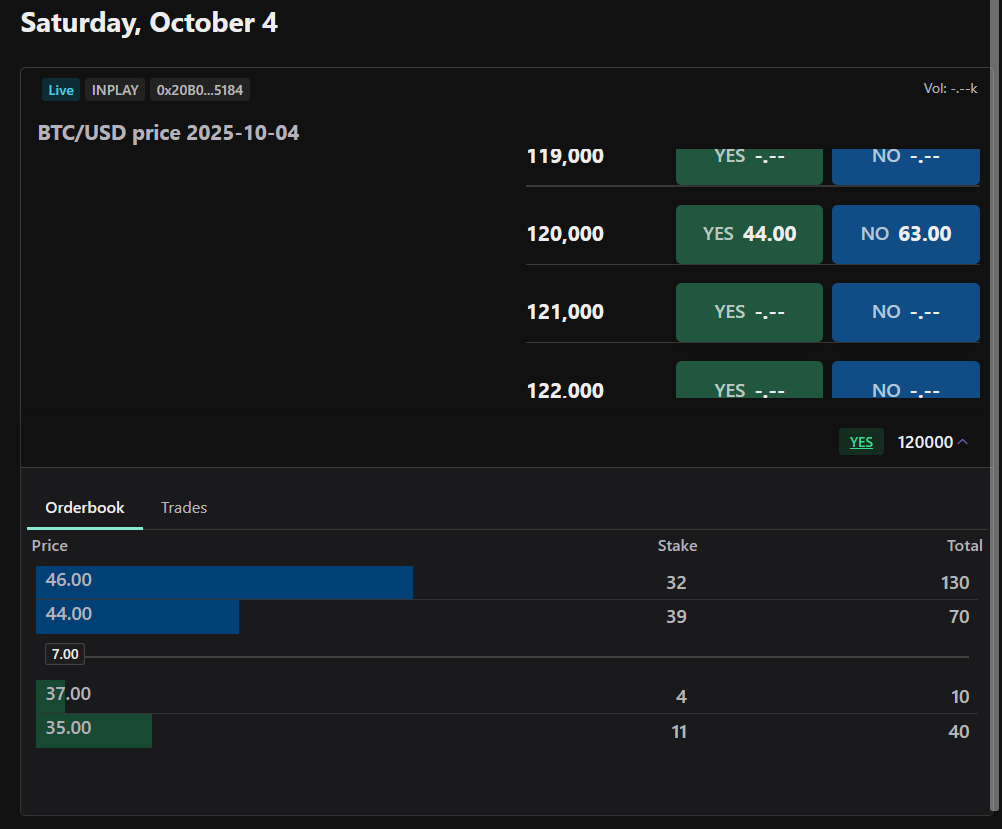

2. Select a Market

Explore available sporting events through the web interface or programmatically via the REST API. Each market represents a binary contract with two possible outcomes (“Yes” or “No”), allowing you to take a position on the result of an event.

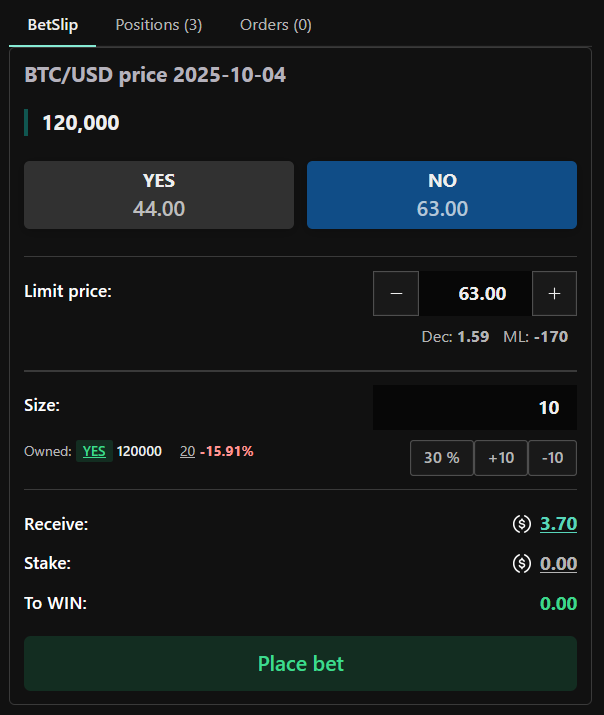

3. Place an Order

Specify your desired price and quantity for a contract. Orders can be limit or market orders, and remain open until matched with a counterparty. The order book displays all active offers, supporting transparent price discovery.

4. Matching and Execution

Orders are matched based on price-time priority within the central limit order book. Once a match occurs, the trade is executed via the Pool contract, swapping positions between participants in a trust-minimized manner.

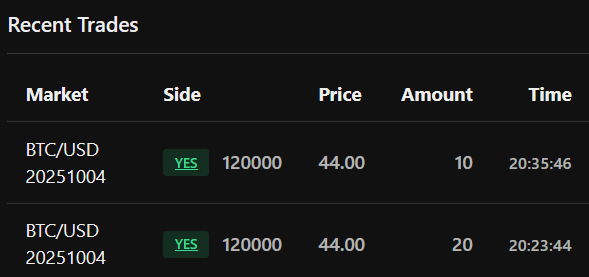

Trades feed

Pool swap execution details

5. Event Resolution

After the sporting event concludes, the Pool contract receives the official outcome from the Gameday Oracle. Following resolution, all positions are settled on-chain. Users can claim any resulting payouts directly from the Pool contract, with all transactions recorded immutably on the blockchain.

6. Settlement Fees

A small platform fee is applied to each settled trade or position. These fees are collected and 100% are distributed from the Staking Pool, supporting the ongoing operation and security of the ecosystem.